-

Posts

3,370 -

Joined

-

Last visited

-

Days Won

30

Content Type

Profiles

Forums

Events

Posts posted by AlanMexicali

-

-

"CFE's DAC rate rises 34%

June 6, 2022

The charge for energy consumed within the domestic high consumption rate (DAC) increased 34 percent annually in Nuevo León, CDMX and Jalisco

MARLÉN HERNÁNDEZ / REFORM AGENCY

MONTERREY, NL.- The High Consumption Domestic electricity rates (DAC) for Mexico City, Nuevo León, Jalisco and the State of Mexico will be up to 34.1 percent higher than in June 2021, reveal data from the Federal Electricity Commission (CFE). ).

The DAC rate, which applies to households whose average consumption exceeds 850 kilowatt-hours (kW-h) per month for a year, in the case of Nuevo León, is made up of two charges.

A charge is fixed, which this month is 130.88 pesos and presented an annual increase of 10.0 percent.

The other, which represents the highest charge, depends on the amount of energy consumed within the DAC category, and for this month the kW-h was established at 6,516 pesos, an annual increase of 34.0 percent and its highest level since there are Available data from 2007.

Thus, the more energy a DAC consumes, the amount of your bill will have an increase closer to 34 percent per year."

Hot weather increases many electric devices consumption. Fridges turn on more often is one example if the house is not using A/C. We use A/C rarely but fans often and use more water so the pumps (alijibe to tinaco and water pressure) are on more, we wash more sweaty clothes, towels and bedding, etc.. Our subsidized CFE bill is about $150 pesos more this cycle. If you are comparing bills from last summer add 34 percent this season. You are in the DAC. Someone pointed out new digital meters are possibly more accurate.

-

1

1

-

-

1 hour ago, Mainecoons said:

Alan just can't grasp the point here, namely that the municipio can use property tax money for operating expenses. The degree which the various municipios collect those taxes and do so and the percentage of those taxes in their budgets is irrelevant to this point. It is the option of each to determine whether and how much.

There is no Federal or State law or rule which stipulates they cannot chose to do so. Hence his blanket statement about property tax not being used for municipio operating funds is simply incorrect.

Everything he posted is interesting if long winded but irrelevant to that fact. No one disputes the method of financing local and state government in Mexico may be less than ideal. No one disputes there is a wide disparity in how the property tax is collected and used around the country.

Here, the Chapala government collects an unusually large share of their operating funds from the property tax and they are pretty diligent about collecting it. I have no idea if this is the case with the Jocotepec municipio.

To me, the very fact that government in Mexico generally does not rely much on this onerous and expensive to collect tax is just another thing in the favor of Mexico. People are literally being property taxed out of their homes NOB and I am happy that is not the case here.

I could/should have modified my comment that predial is deposited into the cities treasury and none of it is used for maintenance of any public places or services but chose not to because usually in city budgets this amount dwarfs in comparision to overall expenditures a city recieves to functiion. Chapala does have a very large percentage (16) of it's budget from collecting predial compared to other cities this size for reasons unique to Chapala, obviously. I presume if predial is in a city's treasury, like I stated, there is a possibility some potholes might be filled with this money, who really knows?

I am sorry by refusing to modify my comment it irrated you. It kept the thread going and was interesting, at least to me.

-

1

1

-

1

1

-

-

If you don't like my source for cities revenue stream how about INEGI data instead? Same percentage federal tax contributions for states and probably similar for cities but I am not really sure.

"How are state revenues made up?

In the income laws of the federative entities of 2022, it was estimated to receive a total of

2 billion 409 thousand 011 million 441 thousand pesos.

Table 1. Estimated total income in the income laws by federal entity 2022

Millions of current pesos

Source: Income Laws of the federal entities, 2022.

However, much of this revenue is not generated or collected directly by the

states, but are obtained through federal transfers. Of

According to the latest data published by the Inegi, in 2020 81.5% of state income

came from federal transfers. On the other hand, only 10.9% of state revenues were their own income. These are resources generated by the states through state taxes, collection of

rights, products, uses, social security contributions or improvement contributions.

7.6% of the total state income came from public debt, which are resources obtained through

of loans that must be authorized by the Legislative Power of each entity. Less than 1%

came from income from initial availability, that is, remaining resources from previous years.

Federal entity Income

Dear Millions of current pesos

Aguascalientes 28,232.8

Baja California 70,917.5

Baja California Sur 18,665.1

Campeche 22,349.9

Coahuila 56,888.3

Colima 18,565.4

Chiapas 104,576.0

Chihuahua 81,352.6

Mexico City 234,000.9

Durango 35,819.8

Guanajuato 92,669.6

Warrior 67,690.9

Hidalgo 54,893.0

Jalisco 137,119.0

Mexico 326,497.7

Michoacan 81,546.1

Federal entity Income

Dear

Morelos 27,144.8

Nayarit 25,081.8

New Leon 118,194.3

Oaxaca 83,808.2

Puebla 104,094.4

Queretaro 45,898.4

Quintana Roo 34,611.2

San Luis Potosi 53,121.9

Sinaloa 58,139.2

Sound 67,931.2

Tabasco 55,954.4

Tamaulipas 65,089.9

Tlaxcala 22,620.4

Veracruz 135,763.2

Yucatan 46,038.1

Zacatecas 33,735.5" -

2 hours ago, Mainecoons said:

Yo8 cited an op ed piece. I cited an official source.

Several years ago there was a piece in the GDL Reporter I believe where the local Presidente at the time stated the Chapala government gets about 70 percent of its operating funds from the local property tax. That was noted as an unusually high figure which it is. This municipio has an usually rich property tax base. Unfortunately for most of its territory that doesn't translate into better services.

You would know that if you lived here.

The fact municipios also get money from the state and feds doesn't change the fact they can and do use property tax revenues for local services as verified by official sources. There's no disputing the case the way most are financed leaves a lot to be desired but that is irrelevant to the point I was making.

You made a general statement they do not use property tax revenues for operating costs and that statement is incorrect.

If the municipio fails to collect sufficient property taxes or collect them at all that does not change the basic fact they can collect them and they can use them for local services.

Article 1. In fiscal year 2021, from January 1 to December 31 of the same year, the Public Treasury of this Municipality will receive income from taxes, improvement contributions, rights, products, uses, income from sales of goods and services, participations and federal contributions, transfers, allocations, subsidies and other aid, as well as income derived from financing, in accordance with the rates, quotas, and rates established in this Law and other laws.

The Municipality adopts and implements the Classifier by Income Items (CRI) approved by the National Accounting Harmonization Council (CONAC), in accordance with the following:

IRA

DESCRIPTION

ESTIMATED INCOME

Total

$359,113,093.31

1

TAXES

$91,235,794.60

1.1

INCOME TAXES

$420,000.00

1.1.1

Public shows

$420,000.00

0.00

1.2

TAXES ON WEALTH

$53,445,645.60

1.2.1

Property tax

$53,445,645.60

1.3

Taxes on production, consumption and transactions

$36,170,149.00

1.3.1

Property transfer tax

$34,035,156.00

1.3.2

Legal business tax

$2,134,993.00

1.4

Foreign Trade Taxes

$0.00

1.5

Payroll and similar taxes

$0.00

1.6

ecological taxes

$0.00

1.7

TAX ACCESSORIES

$1,200,000.00

1.7.1

fines

$258,000.00

1.7.2

Surcharges

$739,000.00

1.7.3

Expenses of Execution and notification of debit

$203,000.00

1.7.4

Update

$0.00

1.7.5

Financing by agreements

$0.00

1.8

OTHER TAXES

$0.00

1.9

TAXES NOT INCLUDED IN THE CURRENT INCOME LAW, CAUSED IN PREVIOUS FISCAL YEARS PENDING SETTLEMENT OR PAYMENT

$0.00

two

SOCIAL SECURITY FEES AND CONTRIBUTIONS

$0.00

2.1

Contributions for housing funds

$0.00

2.2

Social Security Fees

$0.00

23

Savings quotas for retirement

$0.00

2.4

Other fees and contributions for Social Security

$0.00

2.5

Accessories of quotas and Social Security contributions

$0.00

3

IMPROVEMENT CONTRIBUTIONS

$0.00

3.1

CONTRIBUTION OF IMPROVEMENTS FOR PUBLIC WORKS

$0.00

3.1.1

Contributions for public works

$0.00

3.2

CONTRIBUTIONS OF IMPROVEMENTS NOT UNDERSTOOD IN THE CURRENT INCOME LAW, CAUSED IN PREVIOUS FISCAL YEARS PENDING SETTLEMENT OR PAYMENT

$0.00

4

RIGHTS

$86,643,541.86

4.1

RIGHTS FOR THE USE, ENJOYMENT, EXPLOITATION OR EXPLOITATION OF PUBLIC DOMAIN ASSETS

$2,072,146.93

4.1.1

Use of Public Domain Assets

$764,626.93

4.1.2

Land Use

$1,307,520.00

4.2

RIGHTS FOR PROVISION OF SERVICES

$75,689,584.93

4.2.1

licenses

$12,578,800.00

4.2.2

Construction, reconstruction and remodeling permit

$0.00

4.2.3

Other licenses, authorizations or public works services

$1,340,560.00

4.2.4

alignments

$300,000.00

4.2.5

public toilet

$345,600.00

4.2.6

water and sewage

$54,532,150.00

4.2.7

traces

$465,179.40

4.2.8

Civil registration

$445,938.15

4.2.9

Certifications

$671,755.88

4.2.10

Cadastre Services

$4,989,557.00

4.2.11

Fees for review of appraisals

$0.00

4.2.12

Parking lots

$0.00

4.2.13

animal health

$20,044.50

4.3

OTHER RIGHTS

$8,756,810.00

4.3.1

Miscellaneous Rights

$8,756,810.00

4.4

RIGHTS ACCESSORIES

$125,000.00

4.4.1

Accessories

$125,000.00

PENSIONS AND RETIREMENTS

$0.00

9.4

Transfers from the Mexican Petroleum Fund for Stabilization and Development

$0.00

0

INCOME DERIVED FROM FINANCING

0.00

01

INTERNAL INDEBTEDNESS

$0.00

02

EXTERNAL INDEBTEDNESS

$0.00

03

INTERNAL FUNDING

$0.00

Article 2. Taxes for commercial, industrial and service provision activities, public entertainment and on the possession and operation of hearses, which are the subject of the Adhesion Agreement to the National Fiscal Coordination System, signed by the Federation and the State. of Jalisco, will be suspended, as long as the validity of said agreement subsists."

ESTIMATED INCOME

Total

$359,113,093.31

Property tax

$53,445,645.60

2021 Chapala revenue from property taxes was about 16 percent of their operating budget just like the article I posted stated most small cities have in common. Chapala has no more self revenue than many Mexican cities that size. Some probably do have much less self revenue.

-

3 hours ago, Mainecoons said:

Let's see your reference on this. Mine says quite the opposite.

https://tupredial.com/beneficios-de-pagar-impuesto-predial/

From an official government source.

From another source:

Bold is mine.

I did what you asked for in my above post but forgot to quote your post. Your links are much too simplistic in content to be included in this discussion of who funds what in some cities and by how much.

-

Not as easy to caculate this as you might think. If you take the time to read this article you will know more about it than just the article above the other one which is from Mexico City's goverment website.

Cities get mostly Mexican Federal Government tax funding to met their obligations and most rural areas get almost all federal tax money to function.

The best cities operate on about 21 percent of their own local revenue and 74 percent federal tax funding. I might guess Chapala is the typical small city example and might have a low self funding government by revenues collected and recieves most of it's operational funding from federal tax funding.

Predial collection and other local revenues in many cities and towns are pathetic at only 14.2 percent self revenue and 85.8 percent federal funded and rural and ejido they rely on 93.3 percent, on average, on federal tax funding.

This article states SOME cities and towns collect more in the last 20 years but not most.

Some states and their cities and towns are not even trying hard. So obviously it depends greatly in terms of who funds the cities and towns obligations and by what percentage of total costs.

Quote: "... a high dependence on transfers from the federal government (74% of revenues comes from participations and contributions) , a low generation of own income (21%) and little income from the acquisition of debt and initial availability (5%)."

https://imco.org.mx/la-base-irregular-del-federalismo-mexicano-autonomia-fiscal-de-los-municipios/

"RESEARCH CENTER

IN PUBLIC POLICYWho we are Research Indices Monitor Areas

Competitiveness Anticorruption Cities Energy and Environment Government and Finance Justice and Security Inclusive society

Start The Irregular Basis of Mexican Federalism: Fiscal Autonomy of the Municipalities

Article

THE IRREGULAR BASIS OF MEXICAN FEDERALISM: FISCAL AUTONOMY OF MUNICIPALITIES

Fernando Valdes

Investigator

27 October, 2021

By: Fernando Valdés Benavides and Manuel Guadarrama Herrera

Article 115 of the Constitution establishes the municipality as the basis of the federal structure. However, this arrangement deposits some of the tasks that most impact people's lives in the sphere of government that faces the greatest limitations to execute them: the municipalities.

Municipalities are responsible for eight services —management of drinking water and sanitation, public lighting, solid waste management, markets and supply centers, pantheons, slaughterhouses, streets and gardens, and public safety— and nine functions related to urban development and provision of licenses. In addition, the state legislation contemplates up to 26 possible attributions for the municipalities, among which the tasks of education, culture, tourism, public transport, ecology, environment and the municipal offices of the DIF stand out.1

The service and function burdens of municipalities are substantial, but how capable are municipalities to support these responsibilities? According to Article 31 of the Constitution, there are three types of active subjects in tax matters: the federation, the states and the municipalities. However, the Constitution does not establish a homogeneous method in relation to these powers. The states have coincidences in some non-exclusive tax faculties of the federation (see, for example, the residual clause of constitutional article 124). And, although the Constitution establishes that the municipalities can freely manage their finances and collect taxes, they do not have the necessary powers to establish taxes, a task for which they depend on state laws.

Such is the limited and partially protected legal framework under which the country's municipalities operate. But, as we know, federalism is not only instituted: it is also built. Thus, it is worth asking: how are the powers and obligations of the municipalities translated into real capacities?

Capacities and fiscal autonomy

The Organization for Economic Cooperation and Development defines tax autonomy in terms of whether subnational or local governments have the power to introduce or eliminate a tax, define tax rates, establish the tax base, or grant tax benefits or exemptions to taxpayers. As far as public finances are concerned, article 115 of the Constitution states that the federal regulation cannot prevent the municipality from receiving the contributions "established by the States on real estate, its division, division, consolidation, transfer and improvement, as well as those based on the change in value of real estate”.

However, another concept is that of municipal fiscal autonomy. This type of autonomy refers to the municipality's ability to generate its own income through taxes and other contributions. For its measurement, the proportion of own income over total income is considered.

Graph 1 shows an aggregate view of the country's municipal finances. Although municipal revenues have doubled in real terms in the last 20 years, the structure of revenue sources has remained almost unchanged: a high dependence on transfers from the federal government (74% of revenues comes from participations and contributions) , a low generation of own income (21%) and little income from the acquisition of debt and initial availability (5%).

Graph 1. Structure of municipal income in the last 20 years

Own revenues originate from collection and administrative efforts, such as the property tax, the fees charged for services such as drinking water, the issuance of licenses, the civil registry, the products derived from parking and parking meters, the sale and lease of land, fines, surcharges, lags and, finally, improvement contributions: income received by the municipality for carrying out public works that directly benefit individuals or legal entities.

Graph 2 shows the relationship between population and own income at the municipal level. When fitting a local regression model, there seems to be a critical mass from 30,000 inhabitants in which an exponential increase in the population translates into a linear increase in the proportion of own income with respect to total income. In other words: the increase in population seems to have a positive effect on fiscal autonomy. A hypothetical municipality of three million inhabitants would collect approximately 15% more than a municipality of 300,000 and 10% more than one of 30,000. This result could be indicative of the economies of scale that urbanization brings with it, which can allow a better cadastral order, as well as greater administrative specialization and collection efficiency.

Graph 2. Relationship between population and generation of own income

The key ingredient: the predial

Property tax is a historically local tax due to its tangible, immovable and progressive nature. It is key to providing municipalities with fiscal autonomy and the ability to meet their obligations. The administrative base of this tax is the municipal cadastre. The information for calculating the value of the property and the costs of providing municipal services is concentrated there. Therefore, its continuous updating and modernization contributes to a more efficient collection.

Although the General Participation Fund, the Municipal Development Fund and the Control and Collection Fund provide incentives for the collection of property taxes, almost three out of ten municipalities do not collect it. Graph 3 shows the per capita collection of the aggregate property tax at the state level.

Graph 3. Wealth tax collection per inhabitant

The cases of Querétaro, Yucatán, Colima and Puebla stand out, whose municipalities as a whole have managed to increase property tax collection per inhabitant. However, most of the states whose municipalities already collected little have remained relatively stagnant. In fact, in some states —Veracruz, Guerrero, Tamaulipas and Baja California— property tax collection has decreased.

The failures of the federal base

The structural failures of the municipalities are not all the same. Broadly speaking, the municipalities of Mexico can be classified into three groups.

The first are the hundred most populous urban municipalities in the country, corresponds to the municipality's own income. Their administrations are relatively professional and, for the most part, manage to meet their obligations in terms of accounting harmonization and financial discipline.2

Secondly, we have a group of a thousand municipalities that correspond to suburbs, small cities and metropolitan peripheries with an average population of 44,000 inhabitants (highlighted in light green in Figure 4). These municipalities concentrate 43% of the country's municipal revenues, of which 14.2% are their own revenues. These localities face difficulties in complying with their constitutional obligations, since some do not collect enough property taxes, lack updated cadastres and fail in terms of budget transparency.

In the third group we have the rest of the country's municipalities: ejido, indigenous and rural communities with an average population of 3,000 people (highlighted in gray in graph 4). These municipalities only concentrate 5.3% of the country's municipal income, of which only 4.4% corresponds to their own income and 93.3% comes from federal transfers. These municipalities have the same problems as the second group, but aggravated. Some of them do not have the administrative capacity to collect the predial, or face difficulties in collecting it due to their particular social contexts. In addition, most of these municipalities allocate more than two thirds of their expenses to administrative expenses (ie: personal services, general services, materials and supplies). In addition to this, many of them could find themselves in technical bankruptcy.

Graph 4. Municipalities: income groups and population groups

Rebuild the federal structure

The lack of effective policies and incentives to increase municipal collection have left part of the municipalities without the necessary resources and autonomy to take advantage of their main advantage: the ability to act efficiently, focused and in tune with their local contexts.

In a country as plural as Mexico, federalism demands autonomous units with differentiated treatment and a legal framework that is flexible to change. Our fiscal coordination mechanisms and the various compensatory contribution funds have not been up to the challenge. To go no further: the third feature – a flexible legal framework – has simply been absent since the 1990s.

Given the difficulties involved in making substantial changes in fiscal coordination, it is important for municipalities and states to make efforts to increase property tax collection through three complementary mechanisms: the modernization of cadastres, the professionalization of municipal treasuries, and the property tax increase.

We also need new ideas. If we do not want to affect the legal independence of the municipality, we have to evaluate the experiences of other countries in terms of inter-municipal cooperation. For example: if our municipalities with low and medium population were agglomerated into inter-municipalities, they could benefit from economies of scale to collect, manage and provide public goods to their inhabitants. On the other hand, metropolitan areas could emulate inter-municipal consortiums for the provision of metropolitan public goods, as is already the case in some cases, and deepen areas such as security and sustainable mobility, following the example of other countries.

The results of the centralist policies of the last two decades show that the current federal structure is faltering not only because of the weight of its top, but also because of the irregularity of its base. It is time to recement.

*The opinions expressed in this column are the responsibility of the authors and do not represent the institutional position."

Posted in Nexus.

27-10-2021

-

1

1

-

-

23 hours ago, luvsdawgs said:

You forgot an important option, get out there and clean it up. Everyone likes to brag about how little taxes they pay but then expect wonders from that small amount.

Property taxes are only deposited in the city treasury and not used for anything to do with mainenance of any public places or services. These services are all funded by the federal governments alotment of IVA - 16 percent - and SAT taxes to each state according to population. Forget the NOB property tax system here in Mexico. Property tax in Mexico is regulated by the inherited Mexican Constututional Right where no government can charge more for property tax that the poorest Mexican can afford to pay annually. Therefore every government under Constitutional law is limited to what their allowed to charge on every property no matter the value or who owns it. So when you compare your property tax to public services recieved you are not using the Mexican federal property tax system but thinking of the NOB property tax system.

-

-

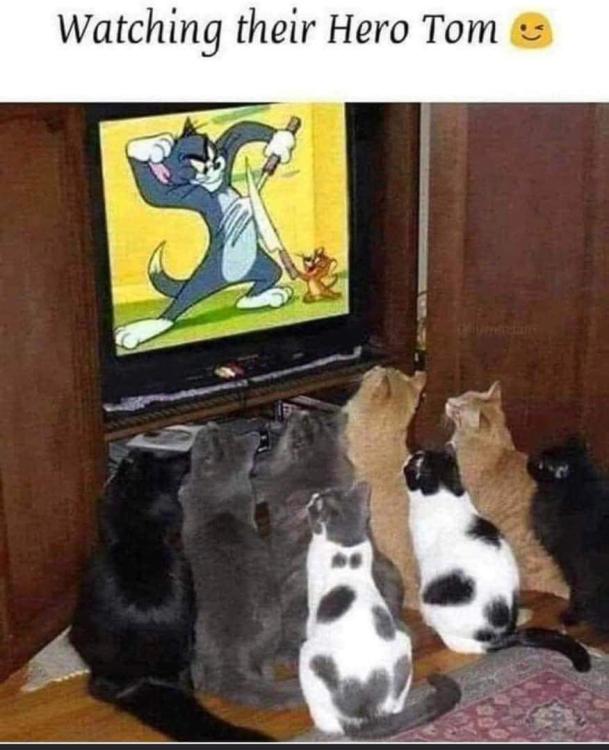

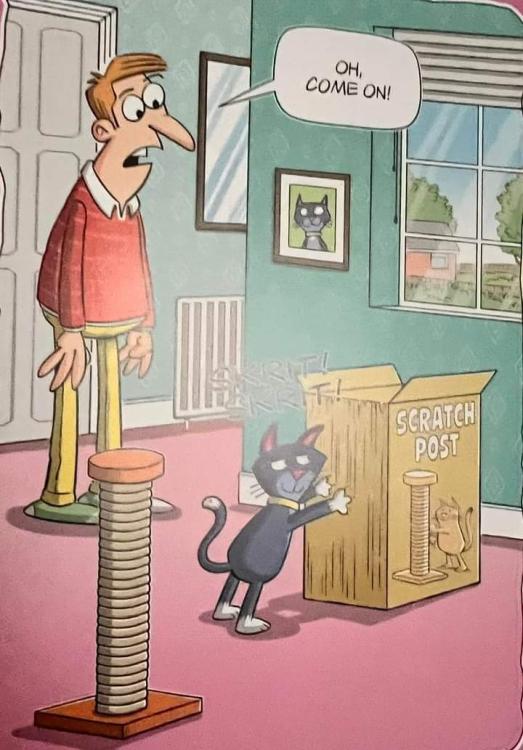

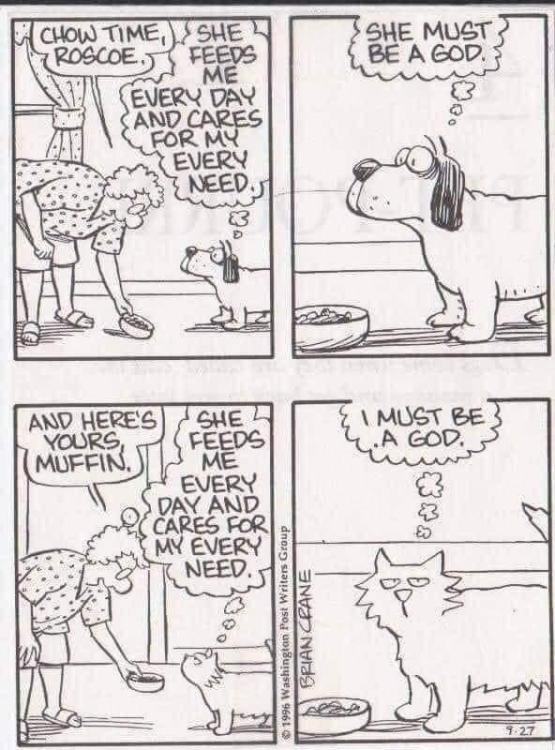

3 hours ago, Natasha said:

WHERE do you find all these gems? Keep it up and ignore Pedro being snarky ..... we cat people LOVE them

I get spamed on my FaceBook news feed by cat lovers websites because I think YouTube somehow gets these sent to my news feed because I watch cat and dog videos. If I don't chuckle I don't download it.

-

1

1

-

-

-

-

-

-

-

-

-

-

Apparently.

-

1

1

-

1

1

-

-

-

-

AMLO raised it substantially and most likely will again. He also dropped the GDP substantially and likely will continue to do so. His health plan INSABI, which replaced the Seguro Popular, is a total failure and his proposed Bienestar health plan is going to be a farse also like it is since he dumped the Seguro Popular. 40,000,000 previously insured low income Mexicans do not use INSABI it is so bad but used the Seguro Popular before AMLO destroyed it.

"In 2021, the national debt in Mexico was around 57.63 percent of the GDP.

...

Mexico: National debt from 2017 to 2027 in relation to gross domestic product (GDP)

7 more rowsCharacteristic National debt in percent of GDP 2020 60.3% 2019 53.32% 2018 53.65% 2017 53.96% -

2

2

-

-

-

-

No more highly trained Federal Police for 2 years now. No more federal government funded civil criminal intelligence agency for 3 1/2 years now. Semi-trained military soldiers taking over for the Federal Police - National Guard. No more collusion with the DEA now. A great setup for them.

Things Better NOB--They can go fishing!

in Ajijic/Chapala/Guadalajara

Posted